Brief Summary:

- Financial markets will be closed on Friday and Monday for Easter then Australia next Friday for ANZAC day. Reduced trading volumes may mean we see little price action until after the shortened weeks.

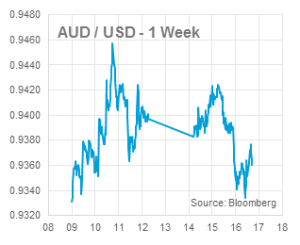

- Chinese monthly production figures were released today at 12:00pm. Chinese GDP grew by 7.4% annually in the first quarter of 2014 as was widely expected by the market. Industrial production grew by 8.8%, slightly lower than the 9.1% expected. The AUD steadied after the figure around 0.9350 against the USD.

- New Zealand’s consumer inflation was lower than expected this quarter causing the NZD to fall back from its recent highs. The Reserve Bank of New Zealand will hold a monetary policy decision next Thursday.

Aussie jobs and minutes

Yesterday the Reserve Bank of Australia released the minutes from its April decision to leave rates on hold at 2.50%. The board tip toed around the high AUD, maintaining that it was ‘historically high’ but abstained from returning to the strength of language seen in late 2013 where it used ‘uncomfortably high’. This abstention may be to allow the high currency to hold back inflation; which is forecast to rise. The latest inflation reading will be released next Wednesday at 11:30am AEST. The minutes went to press before the latest employment numbers, however they forecast unemployment to continue rising.

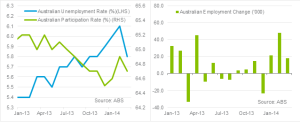

Last Thursday the Australian Bureau of Statistics released March employment numbers that beat expectations. 18,100 new jobs were added after only 7,300 were expected and the unemployment rate declined to 5.8% from 6.1%.

The unexpected decrease in the unemployment rate can be largely put down to a fall in the participation rate; the number of people working or looking for work. Headline figures have been volatile in the last couple of months and it is worth nothing that the trend adjusted figures show little change. After a sorry 2013 employment growth appears to be turning around with three solid months in a row.

USD

U.S. inflation was higher than expected in March with the consumer price index rising to 0.2% MoM. On Monday, U.S. retail sales also grew by more than expected in March, managing 1.1% MoM after 0.8% was expected. Fed Chairwoman Janet Yellen will speak tonight where she may comment on the latest data.

U.S. inflation was higher than expected in March with the consumer price index rising to 0.2% MoM. On Monday, U.S. retail sales also grew by more than expected in March, managing 1.1% MoM after 0.8% was expected. Fed Chairwoman Janet Yellen will speak tonight where she may comment on the latest data.

EUR & GBP