Brief Summary:

- The AUD rallies to its highest level since November 2013.

- U.S. employment data supports the risk rally as alternative measures of the labour market continue to show little progress.

- Australian employment and Chinese trade and GDP numbers will be released in the week ahead.

The rally has legs but what is it standing on?

The AUD touched 0.9386 against the USD today, the highest level since late November 2013. Casting our memories back, that rally began with a seemingly negative piece of information; a deadlocked U.S. parliament that could have resulted in the U.S. defaulting on its debt obligations.

This rally, as we detailed last week, began with a seemingly negative piece of news; a Chinese stimulus package prompted by slowing growth. The AUD was fanned by rhetoric from central bankers at the RBA and U.S. Federal Reserve. Bullish momentum has increased to a point where any positive news pushes the market higher. Today, we saw a 2.3% monthly increase in Australian home loans, normally virtually ignored by the market, bounce the AUD by 25 points.

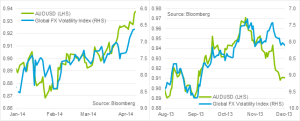

One common market metric seen when the AUD rallies sans fundamentals is falling volatility. The below charts show the two mentioned AUD rallies. AUDUSD is plotted against the Deutsche Bank Global FX volatility index, a weighted measure of the volatility of major currency pairs, on an inverted axis. Volatility is a measure of the up and down price moves of a security. We see that as global volatility declines (moves up on the chart), the AUD appreciates. The index is currently at a multi-year low of 6.62. The previous low was 6.96 in December 2012 and unsurprisingly the AUD made a period high of 1.0552 on that day.

One common market metric seen when the AUD rallies sans fundamentals is falling volatility. The below charts show the two mentioned AUD rallies. AUDUSD is plotted against the Deutsche Bank Global FX volatility index, a weighted measure of the volatility of major currency pairs, on an inverted axis. Volatility is a measure of the up and down price moves of a security. We see that as global volatility declines (moves up on the chart), the AUD appreciates. The index is currently at a multi-year low of 6.62. The previous low was 6.96 in December 2012 and unsurprisingly the AUD made a period high of 1.0552 on that day.

The reason for this is that volatility makes carry trades more risky. A carry trade involves borrowing in a low interest country and investing in a high interest country. Such an investor can make an easy profit on the interest rate carry, so long as these profits aren’t wiped out by an adverse currency movement; which are more common in volatile times.

This is why the NZD, with the highest interest rate in the developed world of 2.75%, is currently near its highest level against the USD ever. The only thing tells us about volatility is that it usually bounces back from its lows. A pick up will likely prompt a reversal of recent gains.

This is why the NZD, with the highest interest rate in the developed world of 2.75%, is currently near its highest level against the USD ever. The only thing tells us about volatility is that it usually bounces back from its lows. A pick up will likely prompt a reversal of recent gains.

The reversal may be on horizon. Australian employment data will be released tomorrow morning at 11:30am. Expectations are for 7,300 jobs to be added in March and the unemployment rate to tick up to 6.1%.Chinese trade and GDP numbers will be released in the week ahead.

USD

Last Friday, U.S. employment data was released showing 192,000 jobs were added in March and the unemployment rate was steady at 6.7%. With 200,000 jobs viewed as a ‘normal’ number and upward revisions of January and February totalling 37,000, a decent figure, however, markets reacted as if it was a disappointing figure. This reaction would not have happened six months ago and it is because of the recent shift in Federal Open Market Committee rhetoric.

Last Friday, U.S. employment data was released showing 192,000 jobs were added in March and the unemployment rate was steady at 6.7%. With 200,000 jobs viewed as a ‘normal’ number and upward revisions of January and February totalling 37,000, a decent figure, however, markets reacted as if it was a disappointing figure. This reaction would not have happened six months ago and it is because of the recent shift in Federal Open Market Committee rhetoric.

In recent months the Fed have shifted their focus from jobs growth and the unemployment rate to other measures of underlying weakness. These factors were discussed in detail by Fed Chairwoman Janet Yellen in her most recent speech What the Federal Reserve Is Doing to Promote a Stronger Job Market. They include the outsize numbers of long-term unemployed and those working part-time that want to work full-time; weakness not suggested by the headline figures. Yellen also mentioned sluggish wage growth and a declining participation rate as reasons to believe the labour market was weaker than perceived. The Fed will release the minutes from its latest monetary policy meeting tomorrow morning.

EUR & GBP

The Bank of England will hold its monthly monetary policy tomorrow.

The European Central Bank have conducted simulations on how it could undertake U.S. Fed style quantitative easing. The central bank is under pressure to be more proactive in combatting looming deflation.