Brief Summary:

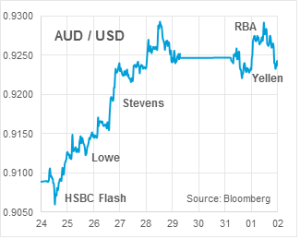

- The AUD extended its rally touching 0.9300 yesterday after the Reserve Bank of Australia decided to hold rates steady at 2.50%.

- Euro area inflation declines again to 0.5% annually.

- U.S. Fed Chairwoman Janet Yellen’s comments are interpreted as more dovish than usual leading asset markets up. The U.S. will release employment data for March on Friday.

The AUD rally – a timeline

The AUD’s recent rally has caught many by surprise because there hasn’t been a clear sentiment driver. As is often the case, the swing began with some simple comments and was stoked by a series of seemingly good reasons to keep buying the AUD.

Last Monday the HSBC Flash Manufacturing Index declined to an eight-month low of 48.1; indicating contraction when below 50.0. Output was registered at an eighteen-month low, however, it contained this comment, “We expect Beijing to launch a series of policy measures to stabilise growth. Likely options include lowering entry barriers for private investment, targeted spending on subways, air-cleaning and public housing and guiding lending rates lower”. The prospects of Chinese stimulus swung the initial negative AUD reaction into an overnight rally that hasn’t looked back.

Last Monday the HSBC Flash Manufacturing Index declined to an eight-month low of 48.1; indicating contraction when below 50.0. Output was registered at an eighteen-month low, however, it contained this comment, “We expect Beijing to launch a series of policy measures to stabilise growth. Likely options include lowering entry barriers for private investment, targeted spending on subways, air-cleaning and public housing and guiding lending rates lower”. The prospects of Chinese stimulus swung the initial negative AUD reaction into an overnight rally that hasn’t looked back.

Speaking at a conference last week, Deputy Governor Philip Lowe and Governor Glenn Stevens both refrained from, what had become a routine, talking down of the currency. In addition, Stevens was confident in the outlook for Australia saying that domestic commentators are overly pessimistic. He stated, “My reading of the actual data is that they suggest that the economy has been doing a bit better than much of our domestic commentary over the past couple of years would have you believe, but not quite as well as many foreign investors seem to have thought.” This new found confidence and relaxed rhetoric fuelled the fire.

Yesterday morning, markets interpreted a dovish tilt in Chairwoman of the U.S. Federal Reserve Janet Yellen’s speech when she reiterated the Fed’s, “overall commitment to maintain extraordinary support for the recovery for some time to come.” Whether it actually was a dovish tilt is up for debate. It appears to simply be the same thing that the Fed have been saying for months.

Most interestingly, China released another Manufacturing PMI at midday on Tuesday that beat market expectations. This figure supported the AUD by strangely the reverse logic to last week’s PMI; that was supportive because it was disappointing. A testament to Glenn Stevens comments last week that “people may be too inclined to fret over what are still relatively small movements in monthly PMIs.”

Yesterday afternoon, the Reserve Bank of Australia held the cash rate at 2.50% and made no real change to its accompanying statement. The board mentioned the high currency, but with far less vigour than in the latter part of 2013 where it described the AUD as ‘uncomfortably high’. The AUD consolidated its gains after this.

The data void that has allowed this rally comes to an end tomorrow. Australian trade and retail numbers will be released tomorrow and U.S. employment numbers will be released on Friday. Those buying rumours need to watch out for those selling facts.

EUR & GBP

Euro area inflation fell again in March to 0.5% YoY. The unemployment rate improved insignificantly to 11.9%. Inflation is now the lowest since the anomalous levels of the global financial crisis and unemployment near its highest level ever; prompting further calls for more action from the European Central Bank. The ECB will meet tomorrow for its monthly monetary policy decision.

U.K. PMI readings, gauges of industry performance, are once again taking small steps backward after outperforming in the latter half of 2013. The latest Manufacturing PMI missed the 56.7 expected with Construction and Services yet to come. The Bank of England will also meet on Thursday for its monetary policy decision.

By Chris Chandler