Brief Summary:

- Markets sold off sharply this week as markets re-adjusted their U.S. interest rate expectations. Bonds lead the charge dragging equity, commodity and foreign exchange markets with it.

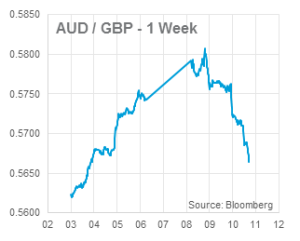

- The Pound remained under selling pressure as the Scottish independence referendum become too close to call. A separation of Scotland would have serious implications on the value of the Pound and the course of Bank of England rates in the future.

USD – The return of the beast

The AUD took up skydiving on Monday afternoon beginning the fastest and farthest sell-off since January 2014. Technical analysts now point out key support levels from the recent trading range have now been breached and there remain no barriers down to below 0.9000. The smoking gun was the release of a Fed research paper that caused a rapid shift in market sentiment towards the future U.S. Federal Reserve rates.

In particular, this paper released by the San Francisco Fed, concluded that markets expect a more gradual rate rises that the Fed itself; stating, “On balance, our evidence indicates that the public seems to expect more accommodative monetary policy than the SEP suggests. The public also appears to be less uncertain about the future course of monetary policy than FOMC participants.” This followed comments made by Fed voting member Charles Plosser on Saturday in the same vein.

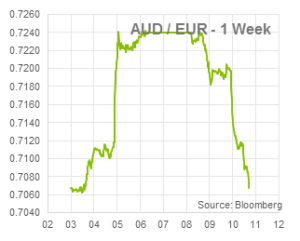

It is the return of the market beast that has laid quiet for most of 2014. Reverberations began in bond markets with sell-offs in U.S. and European bonds. Demonstrating just how important Fed policy is, European bonds fell despite the fact that European Central Bank quantitative easing is imminent. The effects quickly flowed through to foreign exchange markets most visible in G10 commodity currencies like the AUD, NZD and CAD. Talk has surfaced of the unwind of carry trades, where investors borrow in low interest currencies and hold high interest currencies, only days after the same trades were propped up by the ECB announcement.

It is the return of the market beast that has laid quiet for most of 2014. Reverberations began in bond markets with sell-offs in U.S. and European bonds. Demonstrating just how important Fed policy is, European bonds fell despite the fact that European Central Bank quantitative easing is imminent. The effects quickly flowed through to foreign exchange markets most visible in G10 commodity currencies like the AUD, NZD and CAD. Talk has surfaced of the unwind of carry trades, where investors borrow in low interest currencies and hold high interest currencies, only days after the same trades were propped up by the ECB announcement.

EUR & GBP

Chris Chandler