Brief Summary:

- The trading week is shortened by Easter Monday and ANZAC day which will be observed in Australia and New Zealand on Friday.

- Australian inflation reads lower than expected in quarter one and leads the AUD lower.

- The Reserve Bank of New Zealand is widely expected to raise the overnight cash rate from 2.75% to 3.00% tomorrow morning.

AUD falls on inflation

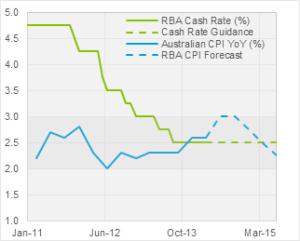

This morning, the Australian Bureau of Statistics released the Consumer Price Index for the first quarter of 2014. The headline number showed prices increasing by 0.6% across the quarter and 2.9% for the year. Underlying inflation, excluding seasonal variations and the reference of the RBA, was steady from last quarter at 2.6% for the year. This flat figure undershot both market expectations and the RBA’s own predictions of underlying inflation reaching 3.0% by the year ending June 2014. The chart on the right shows the leap that must be made for this forecast to now realise.

This morning, the Australian Bureau of Statistics released the Consumer Price Index for the first quarter of 2014. The headline number showed prices increasing by 0.6% across the quarter and 2.9% for the year. Underlying inflation, excluding seasonal variations and the reference of the RBA, was steady from last quarter at 2.6% for the year. This flat figure undershot both market expectations and the RBA’s own predictions of underlying inflation reaching 3.0% by the year ending June 2014. The chart on the right shows the leap that must be made for this forecast to now realise.

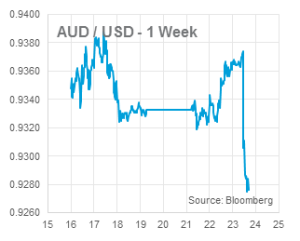

As such, the AUD fell on the prospect that there may be more room for another rate cut if needed. In our view, it is unlikely the figure will result in a major RBA shift but the AUD should remain resilient in the low volatility market conditions that have prevailed for the last month.

USD

At 12:45am today, the HSBC Flash Manufacturing PMI, a survey of manufacturing conditions in China, moved slightly higher to 48.3 in April. Last month’s survey arguably seeded the AUD’s rally when the report stated an extra stimulus program was waiting in the wings. This month the economists that compiled the report maintained, “The State Council released new measures to support growth and employment after the release of Q1 GDP. Whilst initial impact will likely be limited, they signalled readiness to do more if necessary. We think more measures may be unveiled in the coming months and the PBoC will keep sufficient liquidity”.

At 12:45am today, the HSBC Flash Manufacturing PMI, a survey of manufacturing conditions in China, moved slightly higher to 48.3 in April. Last month’s survey arguably seeded the AUD’s rally when the report stated an extra stimulus program was waiting in the wings. This month the economists that compiled the report maintained, “The State Council released new measures to support growth and employment after the release of Q1 GDP. Whilst initial impact will likely be limited, they signalled readiness to do more if necessary. We think more measures may be unveiled in the coming months and the PBoC will keep sufficient liquidity”.

NZD

The Reserve Bank of New Zealand will hold its monthly monetary policy decision tomorrow at 07:00 AEST. The market is widely expecting a continuation of the raising cycle moving the overnight cash rate from 2.75% to 3.00%. The bank have sought to get ahead of inflation pressures with a strong hawkish bias. However, this has placed significant upward pressure on the currency which the bank contends, “remains a headwind to the tradables sector. The Bank does not believe the current level of the exchange rate is sustainable in the long run.” With the rate increase priced in to markets, the bulk of price action will centre on changes to the accompanying statement. The NZD is currently at 12-month highs against the USD.

The Reserve Bank of New Zealand will hold its monthly monetary policy decision tomorrow at 07:00 AEST. The market is widely expecting a continuation of the raising cycle moving the overnight cash rate from 2.75% to 3.00%. The bank have sought to get ahead of inflation pressures with a strong hawkish bias. However, this has placed significant upward pressure on the currency which the bank contends, “remains a headwind to the tradables sector. The Bank does not believe the current level of the exchange rate is sustainable in the long run.” With the rate increase priced in to markets, the bulk of price action will centre on changes to the accompanying statement. The NZD is currently at 12-month highs against the USD.

EUR & GBP

Chris Chandler